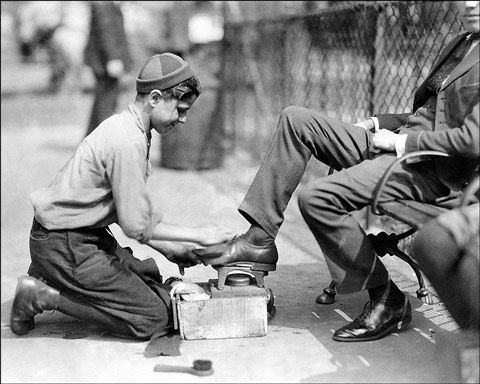

(Pictured: Shoeshine Boy In New York City Circa 1924)

The anecdote goes that avid investor Joe Kennedy was on his way to work in the winter of 1928 and stopped to have his shoes shined. When the shoeshine boy finished he offered up a tip to Kennedy.

“Buy Hindenburg,” he told the millionaire.

Kennedy soon unloaded most of his holdings. When pressed by friends and associates about his reason for selling, Kennedy quipped:

“You know it’s time to sell when shoeshine boys give you stock tips. This bull market is over.”

Less than a year later stock markets around the world collapsed, leaving tens of millions of people impoverished for decades to come.

Kennedy knew something was wrong when everyone, including a shoeshine boy, was talking about the stock market as some sort of magical money making tree.

While the circumstances today may not be exactly like those of the 1920′s, one can’t help but see the similarities.

And though we don’t know of any shoeshine boys giving stock tips today, the following CNBC segment offers a similar warning of market exuberance and irrationality. In it, several well known financial pundits discuss a new strategy that can help you generate serious gains.

As we all know it takes money to make money. But where do you get your investment capital?

Take out a loan, of course, because stock market prices, like real estate values, can only go up from here.

Watch below as Bill Griffeth and Kelly Evans host WSJ’s Jonathan Clements and Premier Financial Advisors’ Mark Martiak for a discussion on what we’re calling the car-stock arbitrage wherein you are (literally) encouraged to take out a 7 year loan with a rapidly amortizing asset as collateral in order to buy stocks. (Zero Hedge)

Wall Street Journal financial columnist Jonathan Clements explains how you, too, can make money in a stock market that has reached all-time highs:

I think it’s a reasonable trade-off. You know, borrow at three or four percent and then go up and invest in the stock market. I wouldn’t actually really be that concerned about whether the car is going to depreciate or not. Yeah, we know the car is going to lose half of its value in the first four years…

The question is ‘what is the better financial transaction to do?’

And if you take a holistic view of your finances, yeah you probably want to take out that loan and invest in equities.

There you have it.

Oh, and when you do get that low interest loan, don’t forget to “Buy Hindenburg.”

Source:: ShtfPlan